Contact Us

Quick Guide: Creating & Preserving WEALTH while investing passively in real estate development Ebook

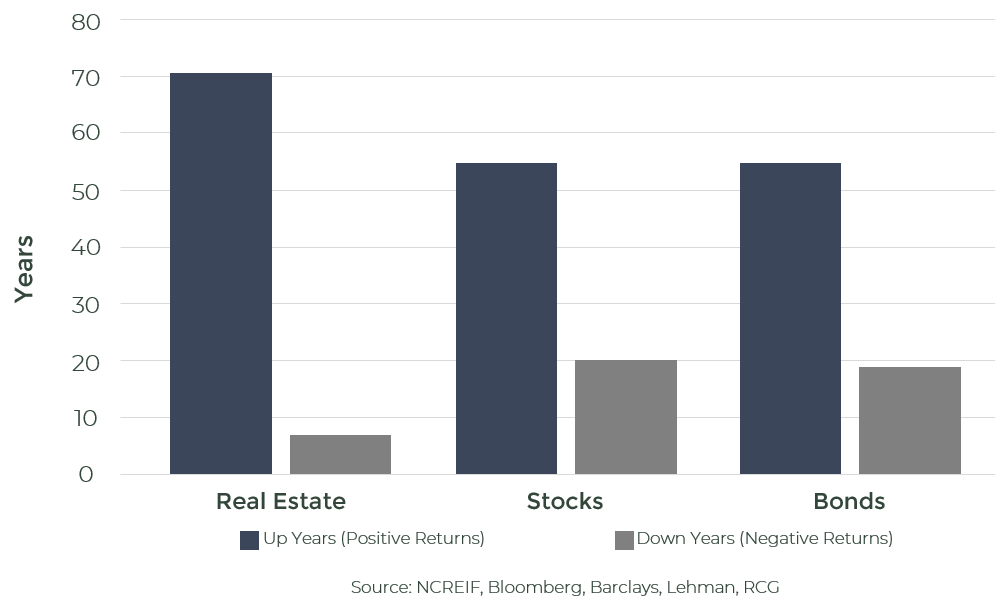

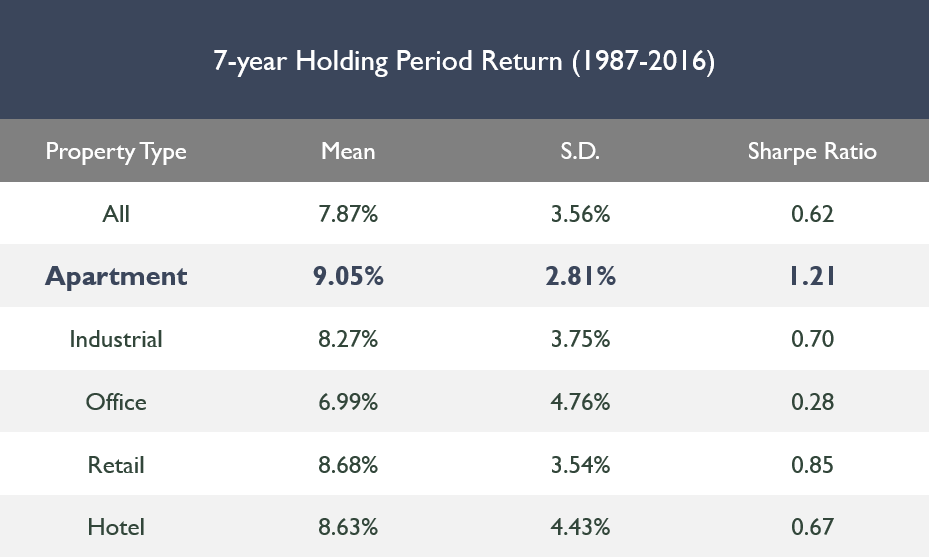

Investing in multifamily assets allows for better returns than any other real estate asset class. The National Multifamily Housing Council (NMHC) presented the research on why multifamily investing returns can’t be beat.

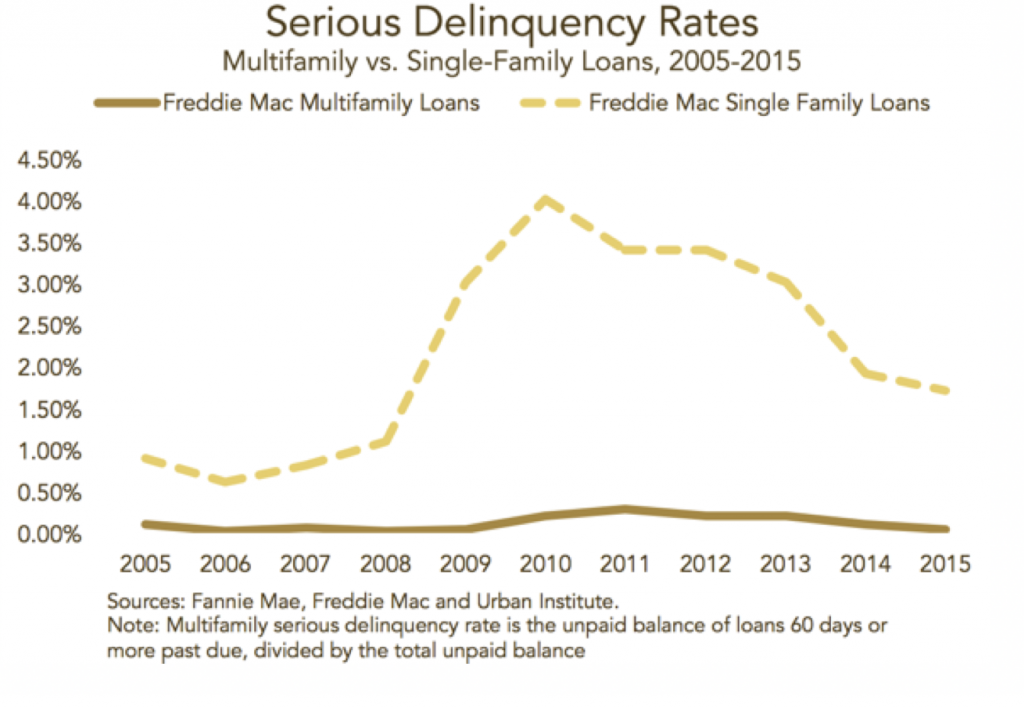

One of the major benefits of investing in stabilized (above 90% occupancy) multifamily assets, is the ability to use permanent, low risk agency financing. Looking back at the crash in 2008, the single family market had a 4.0% default rate versus the multifamily market only have a 0.4% default rate.

Passive investing in multifamily assets provides lower risk debt which allows for greater capital preservation.

One of the major benefits of investing in stabilized (above 90% occupancy) multifamily assets, is the ability to use permanent, low risk agency financing. Looking back at the crash in 2008, the single family market had a 4.0% default rate versus the multifamily market only have a 0.4% default rate.

Passive investing in multifamily assets provides lower risk debt which allows for greater capital preservation.

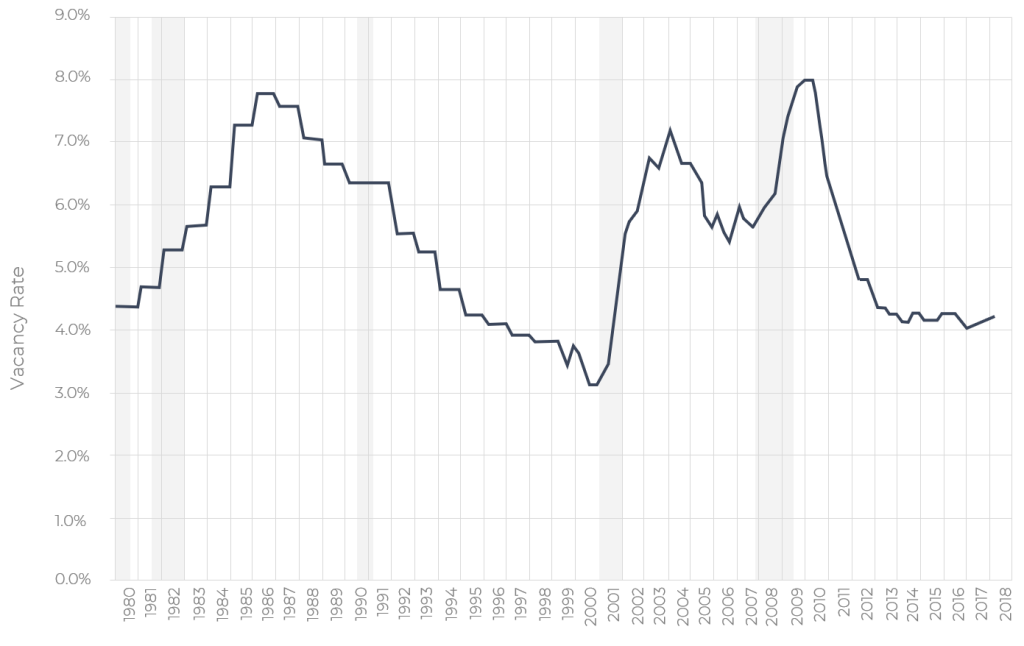

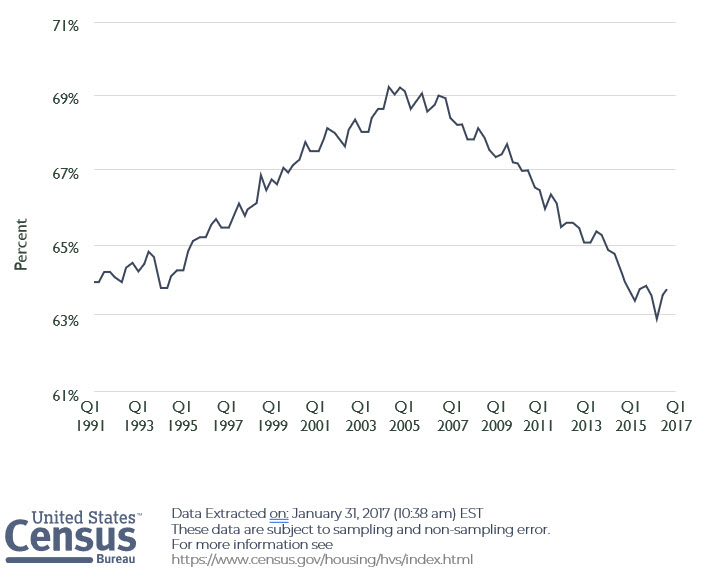

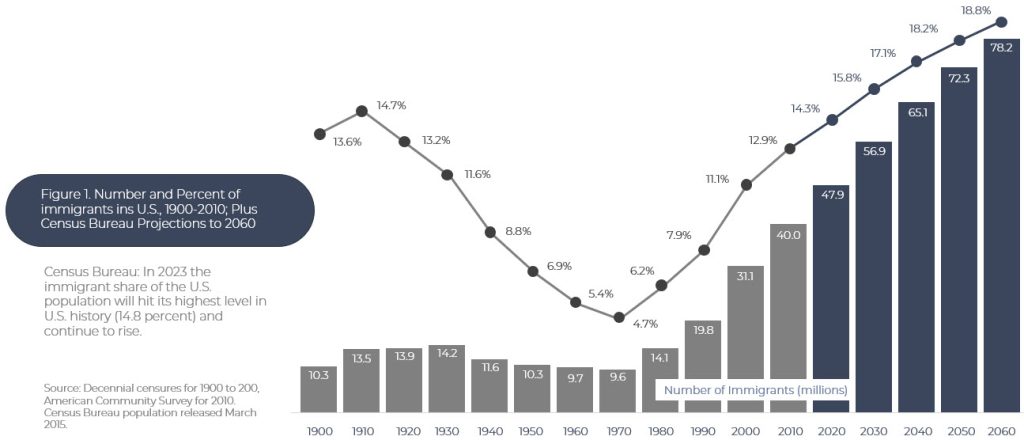

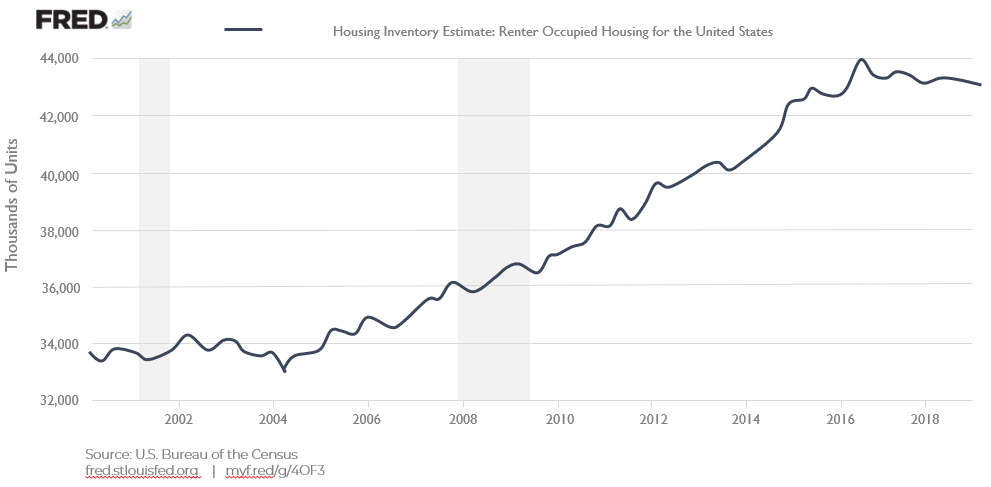

As home ownership is dropping, the population is continuing to increase which drives the demand for apartment living higher and higher.

As home ownership is dropping, the population is continuing to increase which drives the demand for apartment living higher and higher.